Ram Fincorp Loan Review 2025: Eligibility, Interest Rates & How to Apply

Ram Fincorp Loan Review 2025: Eligibility, Interest Rates & How to Apply

In today’s fast-paced financial world, personal loans have become a lifeline for millions of Indians who need quick access to funds — whether for medical expenses, weddings, education, or business growth. Among the many lending platforms in India, Ram Fincorp has earned growing attention in 2025 for offering instant personal loans, transparent processing, and simple eligibility criteria.

This comprehensive Ram Fincorp Loan Review 2025 dives deep into the loan features, interest rates, eligibility requirements, and application process — while comparing it with other popular online lenders like SnapRupee.

What Is Ram Fincorp?

Ram Fincorp is a registered financial service provider that helps borrowers access quick personal loans through an easy online process. The platform connects applicants with multiple lending partners, enabling faster approvals and flexible repayment options.

Whether you’re a salaried employee or self-employed, Ram Fincorp aims to simplify borrowing with minimal documentation, instant eligibility check, and 100% online disbursement directly to your bank account.

Why Choose Ram Fincorp for a Personal Loan in 2025?

The Indian digital lending space is evolving, and borrowers today seek speed, simplicity, and trust. Ram Fincorp stands out by offering:

- Instant approval through a paperless process

- Flexible loan amount options to suit different needs

- Affordable interest rates compared to many NBFCs

- 24x7 online application and quick customer support

Ram Fincorp’s growing reputation in 2025 shows that it caters especially well to young professionals and first-time borrowers who want financial support without long bank visits or hidden conditions.

Ram Fincorp Loan Features 2025

A personal loan from Ram Fincorp offers a balance between accessibility and affordability. Here’s what makes it appealing for Indian borrowers in 2025:

Loan Amount: ₹10,000 to ₹5,00,000

Tenure: 3 months to 36 months

Interest Rate: Starting from 11% per annum (depending on credit profile)

Processing Fee: Between 2%–4% of the loan amount

Disbursement Time: Within 24 hours of approval

Prepayment Option: Available after 3 EMIs

Borrowers can easily calculate their estimated EMI using the EMI Calculator, which helps plan monthly repayments effectively before applying.

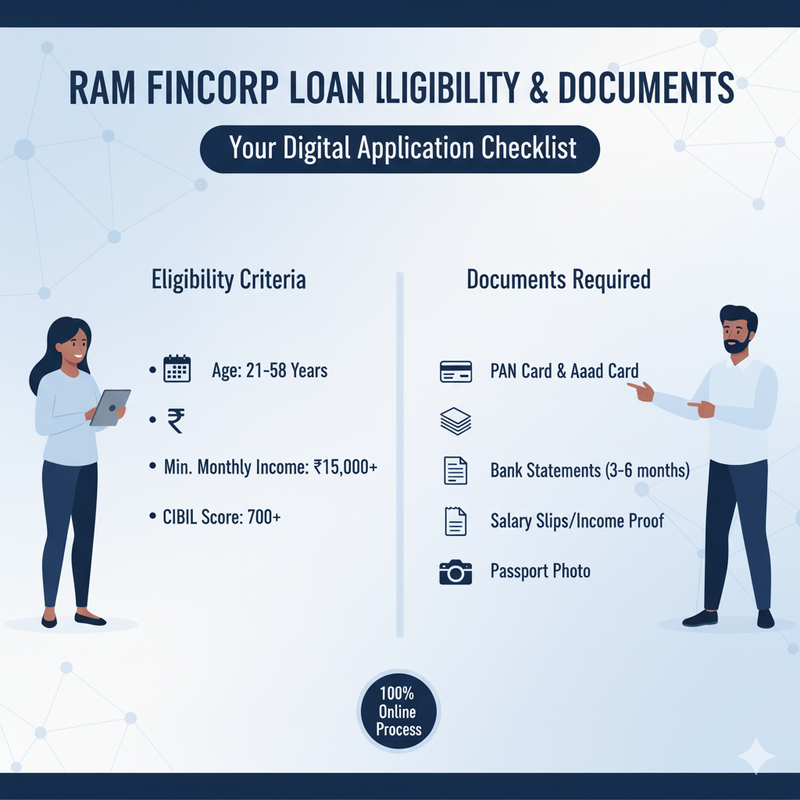

Ram Fincorp Loan Eligibility Criteria

Before applying, it’s important to ensure you meet Ram Fincorp’s eligibility requirements. These may vary slightly depending on your credit score and income level.

To qualify in 2025, applicants should:

- Be an Indian citizen aged between 21 to 58 years

- Have a minimum monthly income of ₹15,000 or more

- Possess a valid CIBIL score (ideally above 700) to secure better loan terms

- Have a steady employment history of at least 6 months

- Maintain an active bank account for loan disbursal

Applicants with lower credit scores can still apply but may be offered smaller amounts or slightly higher interest rates.

For improving your score, check our guide — CIBIL Score?.

Documents Required

Ram Fincorp’s loan process is completely digital, but certain documents are necessary for verification:

- PAN Card and Aadhaar Card (for identity proof)

- Bank statements for the last 3–6 months

- Salary slips or income proof

- Passport-sized photo (digital upload accepted)

The upload process is secure, and all documents are encrypted, ensuring privacy for every applicant.

Ram Fincorp Loan Interest Rates 2025

Interest rates are one of the biggest deciding factors in choosing a loan provider. Ram Fincorp’s interest rate structure in 2025 depends on several factors like your credit score, income stability, and repayment history.

Typically, Ram Fincorp offers:

Interest Rate: 11% to 24% p.a.

Tenure: 3 to 36 months

Processing Fee: Up to 4% of loan amount

Borrowers with higher CIBIL scores enjoy lower interest rates and zero prepayment charges, making Ram Fincorp competitive against digital lenders like SnapRupee Lending Partners.

How to Apply for a Ram Fincorp Loan Online

Applying for a loan at Ram Fincorp is quick and fully online. Follow these simple steps:

- Visit the official website or download the mobile app

- Fill in your personal and employment details

- Choose the loan amount and preferred tenure

- Upload your KYC documents (PAN, Aadhaar, salary slips)

- Submit the application for instant eligibility check

- Get loan approval and receive funds directly in your bank account within 24 hours

You can also explore trusted alternatives and compare offers on the Apply.

Ram Fincorp Loan EMI Calculator

Before applying, it’s smart to calculate your EMI. An EMI calculator helps estimate your monthly repayments, total interest, and overall cost of the loan.

Simply enter your:

- Loan amount

- Interest rate

- Tenure

and get instant results. Try it out at SnapRupee EMI Calculator.

Understanding your EMI before applying helps you plan your budget efficiently and avoid repayment stress later.

Advantages of Choosing Ram Fincorp

Borrowers in 2025 find Ram Fincorp attractive for several reasons:

- Instant loan approval with minimal documentation

- Competitive interest rates for both salaried and self-employed

- Fast disbursal — most loans are credited within 24 hours

- Secure online platform with data encryption

- Transparent charges — no hidden fees or penalties

- 24/7 support through the online contact center (Contact)

Disadvantages and Limitations

While Ram Fincorp offers great convenience, borrowers should stay aware of a few downsides:

- Interest rates may rise for applicants with poor credit history

- Processing fees can add up for small loans

- Shorter tenure options may lead to higher EMIs

To mitigate these issues, maintain a healthy CIBIL score and compare offers across platforms before finalizing your loan.

Ram Fincorp vs Other Loan Platforms

When compared with leading platforms like SnapRupee, MoneyTap, and CASHe, Ram Fincorp performs well on ease of use and customer support. While SnapRupee often provides slightly faster disbursal and broader lender tie-ups, Ram Fincorp focuses on affordable EMIs and flexible repayment schedules for middle-income borrowers.

Ultimately, the best choice depends on your income level, loan amount, and repayment capacity. Using tools like loan comparison and EMI calculators can help you make smarter financial decisions.

Customer Reviews & Experience

Customer feedback in 2025 shows that Ram Fincorp’s instant loan process is appreciated for being quick and transparent. Users highlight the ease of application and responsive support team, though some suggest improvements in real-time tracking and mobile app interface.

Borrowers with good credit history have reported same-day loan disbursal, while those with lower scores faced minor delays due to additional verification.

Final Verdict: Should You Apply for a Ram Fincorp Loan in 2025?

Yes — Ram Fincorp is a reliable choice for individuals seeking small to medium personal loans with minimal hassle. It bridges the gap between traditional banking and fast digital lending by offering affordability, transparency, and quick access to funds.

However, before you apply, make sure you’ve checked your CIBIL score and calculated your EMI using the SnapRupee EMI Calculator. This ensures your repayment capacity aligns with your loan goals.

If you’re ready to begin your financial journey, apply directly via the official Ram Fincorp site or explore partner platforms like SnapRupee Apply to compare offers from verified lenders.

Conclusion: Simplify Borrowing with Confidence

Your financial health defines your loan eligibility. By maintaining a solid credit score, timely repayments, and responsible financial behavior, you can access better interest rates and larger loan amounts with lenders like Ram Fincorp.

In 2025, digital lending continues to evolve — empowering borrowers with speed, safety, and smart tools to manage credit effectively. Before you hit “Apply,” know where you stand and make every borrowing decision an informed one.

To explore more insights, financial tools, and expert tips, visit the SnapRupee Blog and learn how to make the most of your next loan.