What Is a Short-Term Loan? Beginner’s Guide for Indians | SnapRupee

What is a Short-Term Loan? A Beginner’s Guide for Indians

A short-term loan is a type of borrowing designed to meet urgent cash needs over a relatively brief period. Essentially, it’s a quick loan that you take out for months rather than years. Unlike a home loan or education loan, which last for many years, short-term loans are typically repaid within 6 to 12 months [source].

In practical terms, think of a short-term loan as a helpful cushion for temporary expenses. You borrow a small lump sum and promise to pay it back (with interest) by the due date, usually your next payday or within a few weeks or months. These loans often have fast approval and minimal paperwork, so you can get funds “in minutes” or the same day [SnapRupee]. Many are unsecured, meaning you don’t pledge any asset – the lender trusts you to pay back based on your income or credit profile.

Key features of short-term loans include quick access to cash and flexible repayment. They carry higher interest rates than longer loans, but that’s the trade-off for getting money fast [Loan].

For example, Airtel’s financial blog notes that short-term loans have fast approval, minimal documents, and flexible terms – all geared for immediate needs Apply here. highlights that their platform can match you with multiple short-term loan offers in under 60 seconds, with “no long forms” and “bank-level security.” In other words, these loans are meant to be quick and easy, not the years-long commitment of typical loans.

Common Types of Short-Term Loans in India

There are several varieties of short-term loans popular in India. The most common include:

1. Personal Loans

Unsecured loans you can use for almost any purpose (wedding, travel, medical bills, etc.). In India, many banks and NBFCs offer small personal loans specifically for short-term needs. For example, a short-term personal loan might be up to a few lakhs with a tenure of 6–18 months. These loans are widely used for things like weddings, higher education courses, home repairs, or consolidating debt [source].

2. Payday Loans

These are very short-term advances that cover your expenses until the next payday. A payday loan is unsecured and repaid in one lump sum on your next salary date. They often come with minimal documentation and instant disbursal, but the interest rates are quite high due to the short tenure [Tata Capital]. In India, payday loans (sometimes called microloans or cash advances) typically span from a few days up to 60 days [i.e].

3. Credit Card Loans

Many credit cards let you take a loan against your card’s limit. This credit card loan (or “loan on credit card”) taps into your unused limit as cash, repaid over fixed EMIs. It’s pre-approved and quick, but usually carries higher interest than a regular personal loan. Essentially, you borrow a chunk of your available card credit, and the bank converts it into a term loan. As ICICI Bank explains, these loans are “ideal for short-term, quick access to funds,” though personal loans often have lower rates.

4. Mini Cash Loans

This is a very small personal loan for tight emergencies. A mini cash loan typically ranges from ₹10,000–₹50,000 with a tenure up to 6 months. It’s essentially a “pocket-sized” loan – you apply online, get instant approval, and repay in a few installments. Loan aggregators note that mini cash loans require minimal paperwork and are perfect for urgent, small-amount needs. If you’ve searched “mini cash loan,” this is likely what you found: a quick, unsecured loan with short tenure for things like urgent travel, bills or small purchases [SnapRupee Mini Loan].

There are other short-term credit options too – for example, gold loans (secured loans against gold jewelry) and overdrafts on bank accounts. Gold loans disburse quickly and often at lower interest, but they require collateral. Overdraft facilities let you withdraw over your account balance up to a limit, charging interest only on what you use. While these are also short-term borrowing options, the main types first-time borrowers ask about are personal loans, payday loans, credit card loans, and mini cash loans [airtel].

Typical Use Cases for Short-Term Loans

Short-term loans are most useful for urgent or temporary expenses that can’t wait for long-term financing. Examples include:

- Medical Emergencies: Unexpected hospital bills or sudden treatments often need cash now. Many borrowers take a short-term personal or mini cash loan to pay medical costs.

- Bill Payments & Utilities: When you face immediate bills (electricity, phone, credit card bills, etc.) without sufficient cash, a short-term loan can “bridge the gap” until you have funds.

- Education & Tuition: Students sometimes use a short-term loan to pay for exam fees, online courses, or short training programs – essentially “mini education loans” for quick payments.

- Weddings & Celebrations: In India, wedding or festival expenses can come unexpectedly. People often borrow a small personal loan to cover venue booking, catering, or jewelry costs.

- Travel & Vacation: Short vacations or emergency travel (family emergencies abroad, etc.) can be funded by a short-term loan instead of draining savings.

- Home Repair or Renovation: H Sudden home repairs (plumbing, electrical, structural fixes) may require quick funds. A short-term loan can cover repair costs until you repay it through your salary.

- Small Purchases: Buying a gadget (phone, laptop) or appliances on the spot, especially on EMI, can also be done with a short-term loan for convenience.

In general, any temporary cash crunch – like major car repair, moving costs, or essential life events – may prompt a borrower to consider a short-term loan[Guidelines].These loans are purposely designed for such time-sensitive needs.

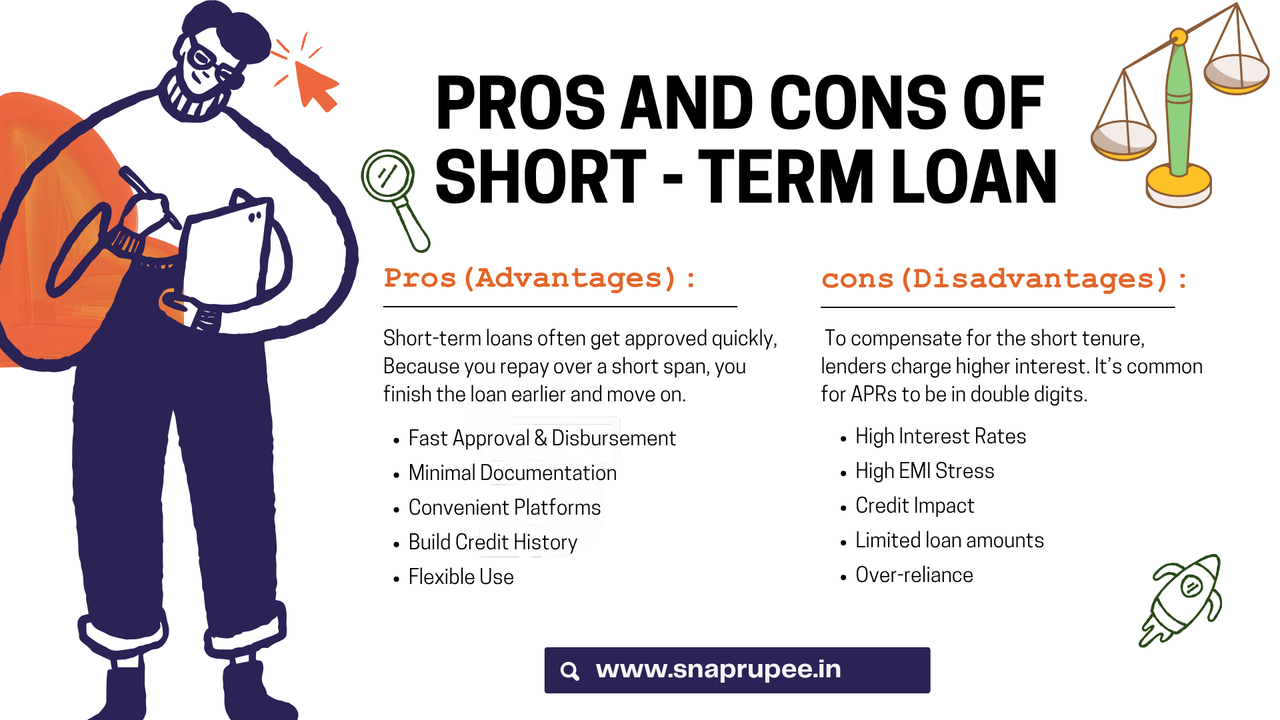

Pros and Cons of Short-Term Loans

Pros (Advantages)

- Fast Approval & Disbursement: Most short-term loans are approved quickly, sometimes within minutes. Many lenders boast instant or same-day disbursal. For example, SnapRupee advertises “instant approval” and transferring money to your account in minutes[SnapRupee].

- Minimal Documentation: These loans often require just ID proof and minimal paperwork. You typically don’t need collateral or property documents, unlike home loans.

- Flexible Use: There are no restrictions on how you use the funds. You can use them for medical bills, travel, education, home fixes, etc.. In fact, RBI-regulated guidelines note that personal loans (a type of short-term loan) can be used for anything from weddings to education to business.

- Build Credit History: : If you repay on time, a short-term loan can help improve your credit score, making future borrowing easier. Short-term loans are often reported to credit bureaus (SnapRupee emphasizes they connect you to RBI-approved lenders and stress transparent APRs).

- Convenient Platforms: Many lenders have 100% online processes. For example, mini cash loans and payday loans are available through apps and websites, requiring just a salary slip or bank statement.

Cons (Disadvantages)

- High Interest Rates:: To compensate for the short tenure, lenders charge higher interest. It’s common for APRs to be in double digits (even 400% annualized for payday loans). In India, some payday and quick loans can have 30–50% interest rates for 30–60 day tenures. Credit card loans and mini cash loans also charge higher rates than long-term personal loans.

- High EMI Stress: Because you repay quickly, your monthly EMIs (or lump-sum payments) can be large. A short repayment term means you might pay a higher monthly amount than a longer loan, which can strain budgets. You must ensure you can meet these payments on time.

- Potential Fees: can strain budgets. You must ensure you can meet these payments on time.

- Potential Fees: Some lenders add fees (processing charges, late fees) that can eat into your loan amount. If you delay payments, penalty fees can make the loan very expensive. Short-term loan terms sometimes have hidden fees if you don’t read the fine print.

- Credit Impact: Missing payments on such loans can harm your credit score quickly, since the loan term is brief. Payday loans are especially risky: if you can’t repay by the due date, you face rollovers and very high interest].

- Over-Reliance:: Easy access to quick cash can tempt some to borrow too often, leading to debt cycles. Financial advisors warn that short-term loans should only be used for urgent needs, not routine expense. In summary, short-term loans offer quick relief but at a cost. It’s essential to compare options, read terms carefully, and borrow only what you can repay on time.

How SnapRupee Can Help

SnapRupee is a loan comparison marketplace that helps borrowers find the best loan options from RBI-regulated lenders. Instead of approaching one bank at a time, you can use SnapRupee’s platform to apply once and get matched with multiple lenders. According to SnapRupee’s website, they focus on speed and transparency – you can “complete a short eligibility check and get matched with the best offers in under 60 seconds”. Their process is 100% online and paperless. For example, their loan calculator page recommends you always compare interest rates and keep a good credit score to get the best deal For example, their Loan Calculator helps estimate EMI and interest. compare interest rates and keep a good credit score to get the best deal[Loan Calculator].

SnapRupee works with “5+ RBI-regulated partners” and compares “60+ offers” to find you the best rate. They highlight benefits such as instant approval, secure processing, and zero hidden fees. If you’re unsure about the process, SnapRupee’s FAQ notes that their team is available to help – “We’re here to help. Reach out to us with any questions or concerns” Contact Page ensures support for users at any stage.

By using SnapRupee, you can quickly view multiple personal loan offers (including short-term and mini cash loans) side by side and choose one that fits your needs and budget.